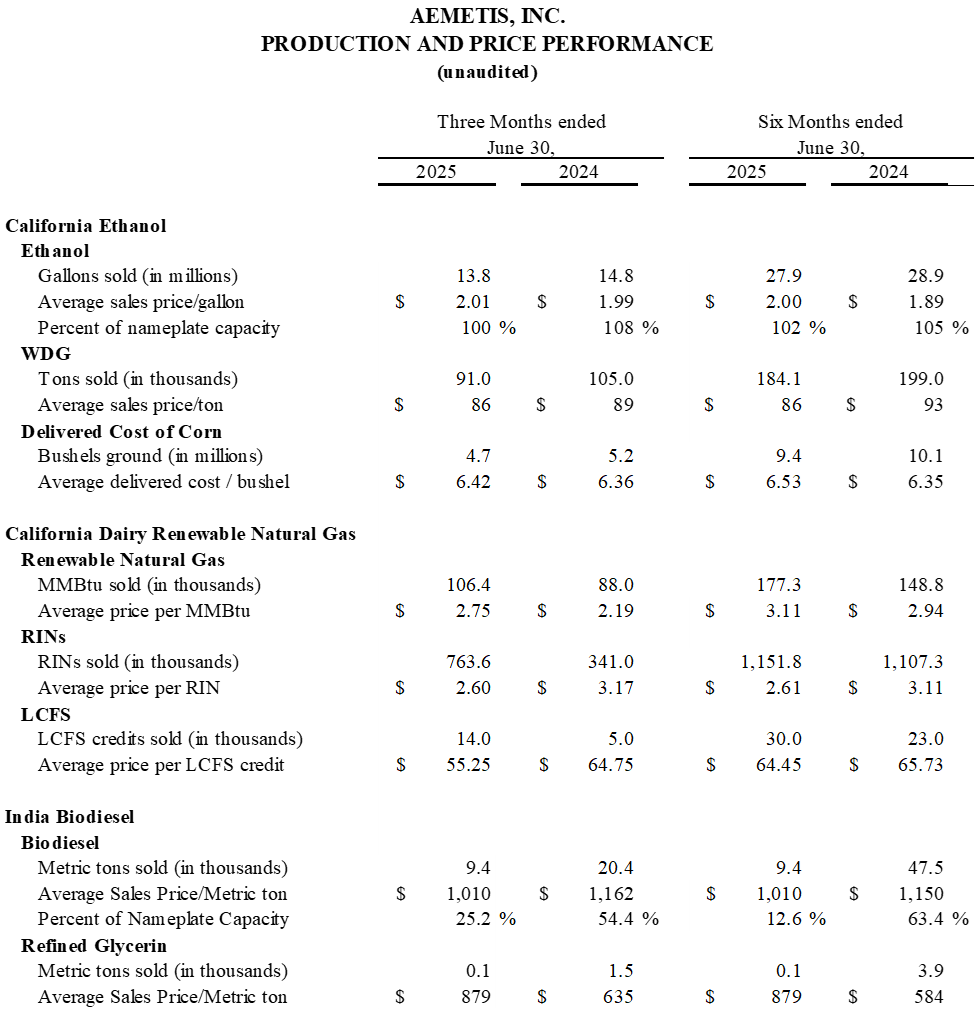

- Revenue increased $9.3M from the first quarter of 2025 to $52.2M, driven by the restart of India biodiesel deliveries under new order from Oil Marketing Companies.

- Aemetis Biogas recognized $3.1M in revenue from 11 digesters; CARB approved 7 new LCFS pathways in Q2.

- Signed $27M agreement with NPL to construct H₂S and compression units for 15 dairy digesters.

- Operating loss improved by $4.9M from the first quarter of 2025, reflecting reduced SG&A in the second quarter of 2025; net loss flat from the second quarter of 2024 after adjusting for one-time items.

- Appointed new CFO with IPO experience for our India subsidiary. The India subsidiary is targeting a public listing in early 2026.

CUPERTINO, Calif., August 7, 2025 – PRISM MediaWire – Aemetis, Inc. (NASDAQ: AMTX), a renewable natural gas and renewable fuels company focused on low and negative carbon intensity products that lower fuel costs and reduce emissions, today announced its financial results for the three and six months ended June 30, 2025.

“Revenues of $52.2 million during the second quarter of 2025 are an increase of $9.3 million from the $42.9 million revenues during the first quarter of 2025, reflecting continued execution by our California Ethanol and Dairy Renewable Natural Gas segments, along with the fulfillment of new India Oil Marketing Companies orders. We look forward to additional revenues from the seven dairy digester RNG pathways recently approved by CARB and the revenues from federal Section 45Z production tax credits that were extended to year 2029 in the One Big Beautiful Bill Act.”

odd Waltz, Chief Financial Officer of Aemetis

“We are pleased with the continued growth of Aemetis Biogas production and continued progress with building a large dairy digester to process waste from multiple dairies which is already producing biogas and will be completed in August. The Section 45Z tax credit income and operating cash flow is expected to be significantly increased in our California Ethanol segment by reducing natural gas consumption with the mechanical vapor recompression project that has completed several steps of fabrication and construction.”

Eric McAfee, Chairman and CEO of Aemetis

Today, Aemetis will host an earnings review call at 11:00 a.m. Pacific time (PT).

Live Participant Dial In (Toll Free): +1-888-506-0062 entry code 655740

Live Participant Dial In (International): +1-973-528-0011 entry code 655740

Webcast URL: https://www.webcaster4.com/Webcast/Page/2211/52764

For details on the call, please visit http://www.aemetis.com/investors/conference-calls/

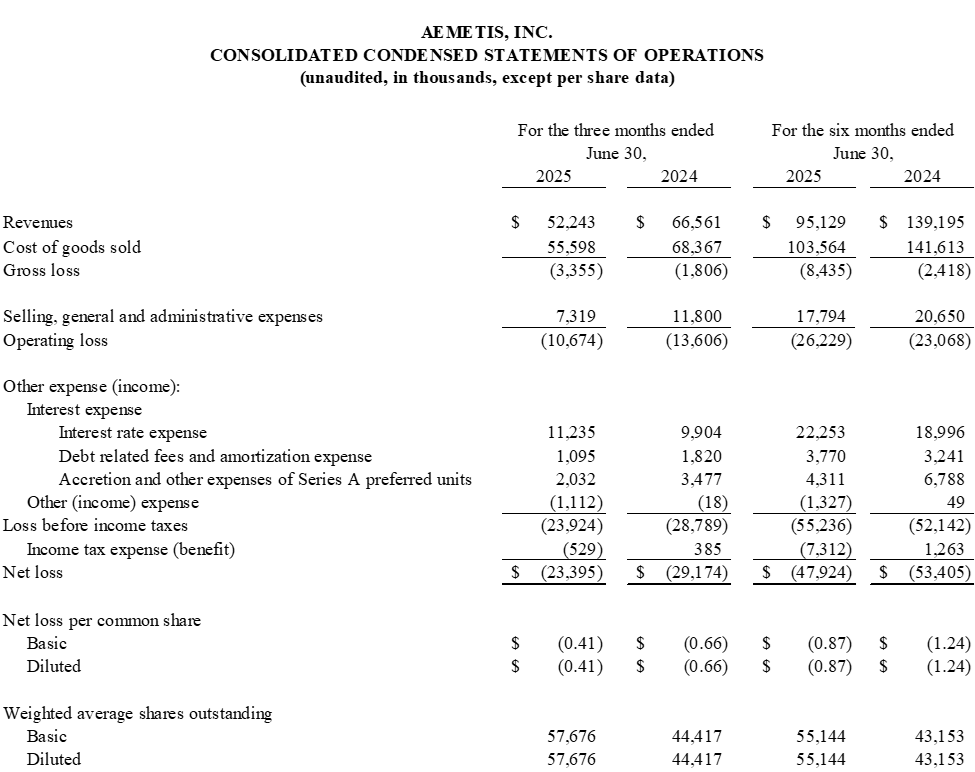

Financial Results for the Three Months Ended June 30, 2025

Total revenues during the second quarter of 2025 were $52.2 million compared to $66.6 million for the second quarter of 2024. Our Keyes plant operated at a slightly lower grind rate to maximize margins during the second quarter of 2025. Our Dairy Natural Gas segment produced 106,400 MMBtu from eleven operating dairy digesters and reported $3.1 million of revenue. Our India Biodiesel business recognized $11.9 million of revenue primarily from the new allocation that converted into sales to the India Oil Marketing Companies during the second quarter of 2025.

Gross loss for the second quarter of 2025 was $3.4 million compared to a $1.8 million gross loss during the second quarter of 2024.

Selling, general and administrative expenses were $7.3 million during the second quarter of 2025 which was a significant decrease from $11.8 million during the same period in 2024, driven primarily by the recognition of a loss on asset disposals of $3.6 million during the second quarter of 2024.

Operating loss was $10.7 million for the second quarter of 2025, an improvement from the operating loss of $13.6 million for the same period in 2024.

Interest expense, excluding accretion of Series A preferred units in the Aemetis Biogas LLC subsidiary, increased slightly to $12.3 million during the second quarter of 2025 compared to $11.7 million during the second quarter of 2024. Additionally, Aemetis Biogas recognized $2.0 million of accretion of Series A preferred units during the second quarter of 2025, a large decrease from $3.5 million during the second quarter of 2024.

Net loss was $23.4 million for the second quarter of 2025, a significant improvement from $29.2 million for the second quarter of 2024.

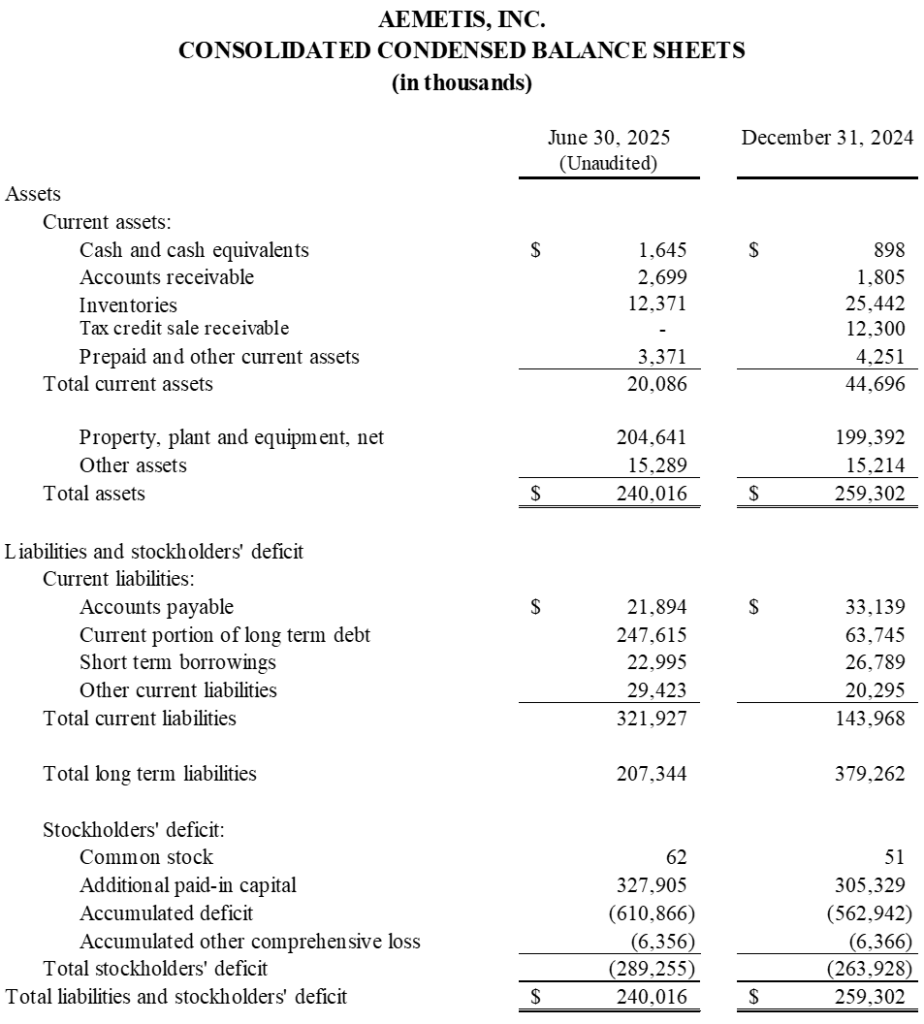

Cash at the end of the second quarter of 2025 was $1.6 million compared to $900 thousand at the close of 2024. We recorded investments in capital projects related to the reduction of the carbon intensity of Aemetis ethanol and construction of dairy digesters of $3.6 million for the second quarter of 2025.

Financial Results for the Six Months Ended June 30, 2025

Revenues were $95.1 million for the first half of 2025 compared to $139.2 million for the first half of 2024, with the lower amount primarily due to delays with the receipt of contracts in India from the government-owned Oil Marketing Companies.

Gross loss for the first half of 2025 was $8.4 million compared to a gross loss of $2.4 million during the first half of 2024.

Selling, general and administrative expenses were $17.8 million during the first half of 2025 compared to $20.7 million during the first half of 2024, including the recognition of a loss on asset disposals of $3.6 million during the first half of 2024.

Operating loss was $26.2 million for the first half of 2025 compared to $23.1 million for the first half of 2024.

Interest expense was $26.0 million during the first half of 2025, excluding accretion and other expenses of Series A preferred units in our Aemetis Biogas LLC subsidiary, compared to interest expense of $22.2 million during the first half of 2024. Additionally, our Aemetis Biogas LLC subsidiary recognized $4.3 million of accretion and other expenses in connection with preference payments on its preferred units during the first half of 2025 compared to $6.8 million during the first half of 2024.

Net loss for the first half of 2025 was $47.9 million, an improvement from a net loss of $53.4 million during the same period of 2024. Investments in capital projects of $5.4 million were made during the first half of 2025, including investments in capital projects related to Aemetis Biogas of $4.1 million.

About Aemetis

Headquartered in Cupertino, California, Aemetis is a renewable natural gas, renewable fuel, and biochemicals company focused on the operation, acquisition, development, and commercialization of innovative technologies that lower fuel costs and reduce emissions. Founded in 2006, Aemetis is operating and actively expanding a California biogas digester network and pipeline system to convert dairy waste gas into Renewable Natural Gas. Aemetis owns and operates a 65 million gallon per year ethanol production facility in California’s Central Valley near Modesto that supplies about 80 dairies with animal feed. Aemetis owns and operates an 80 million gallon per year production facility on the East Coast of India producing high quality distilled biodiesel and refined glycerin for customers in India and Europe. Aemetis is developing a sustainable aviation fuel (SAF) and renewable diesel fuel biorefinery in California to utilize renewable hydrogen, hydroelectric power, and renewable oils to produce low carbon intensity renewable jet and diesel fuel. For additional information about Aemetis, please visit www.aemetis.com.

Company Investor Relations

Media Contact:

Todd Waltz

(408) 213-0940

investors@aemetis.com

External Investor Relations

Contact:

Kirin Smith

PCG Advisory Group

(646) 863-6519

ksmith@pcgadvisory.com

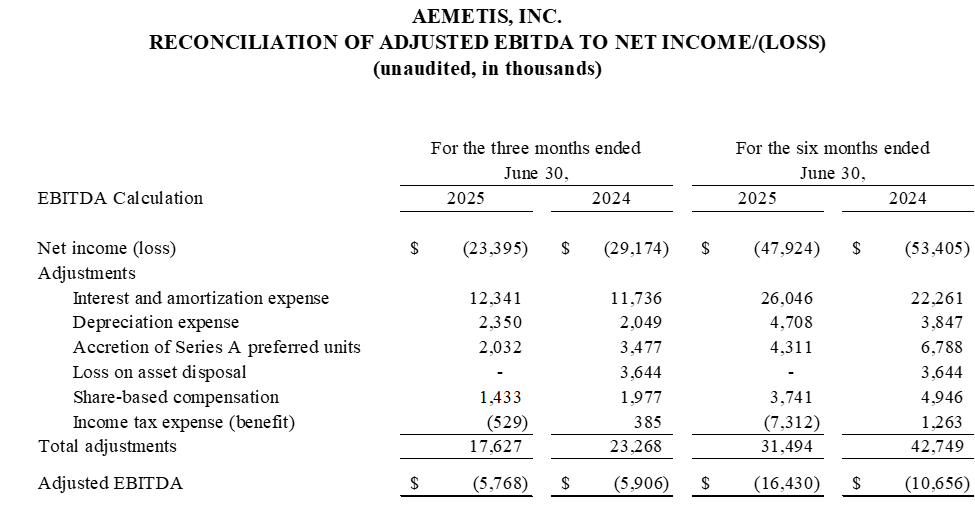

Non-GAAP Financial Information

We have provided non-GAAP measures as a supplement to financial results based on GAAP. A reconciliation of the non-GAAP measures to the most directly comparable GAAP measures is included in the accompanying supplemental data. Adjusted EBITDA is defined as net income/(loss) plus (to the extent deducted in calculating such net income) interest and amortization expense, income tax expense or benefit, accretion expense, depreciation expense, and share-based compensation expense.

Adjusted EBITDA is not calculated in accordance with GAAP and should not be considered as an alternative to net income/(loss), operating income or any other performance measures derived in accordance with GAAP or to cash flows from operating, investing or financing activities as an indicator of cash flows or as a measure of liquidity. Adjusted EBITDA is presented solely as a supplemental disclosure because management believes that it is a useful performance measure that is widely used within the industry in which we operate. In addition, management uses Adjusted EBITDA for reviewing financial results and for budgeting and planning purposes. EBITDA measures are not calculated in the same manner by all companies and, accordingly, may not be an appropriate measure for comparison.

Safe Harbor Statement

This news release contains forward-looking statements, including statements regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events or other statements that are not historical facts. Forward-looking statements in this news release include, without limitation, statements relating to our five-year growth plan; trends in market conditions with respect to prices for inputs for our products versus prices for our products; our ability to fund, develop, build, maintain and operate digesters, facilities and pipelines for our dairy renewable natural gas segment; our ability to fund, develop and operate our SAF, renewable diesel, and carbon capture and sequestration projects, including obtaining required permits; our ability to receive awarded grants by meeting all of the required conditions, including meeting the minimum contributions; our intention to repurchase the Series A preferred units relating to our Aemetis Biogas subsidiary and the expected valuation premium thereof; and our ability to raise additional capital. Words or phrases such as “anticipates,” “may,” “will,” “should,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “showing signs,” “targets,” “will likely result,” “will continue” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on current assumptions and predictions and are subject to numerous risks and uncertainties. Actual results or events could differ materially from those set forth or implied by such forward-looking statements and related assumptions due to certain factors, including, without limitation, competition in the ethanol, biodiesel and other industries in which we operate, commodity market risks including those that may result from current weather conditions, financial market risks, customer adoption, counter-party risks, risks associated with changes to federal policy or regulation, and other risks detailed in our reports filed with the Securities and Exchange Commission, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and other filed documents. We are not obligated, and do not intend, to update any of these forward-looking statements at any time unless an update is required by applicable securities laws.

(Tables follow)

Source: Aemetis