Key Takeaways

- Restated Financials Filed — BioStem filed restated interim and annual financial statements for 2023–2025, aligning with US GAAP for revenue recognition.

- Revenue Classification Update — Bona fide services fees from Venture Medical are now treated as contra revenue, lowering gross sales but not impacting EBITDA or cash flow.

- Audit and Uplist Progress — BioStem’s KPMG-led independent audit will conclude by Q1 2026, supporting plans to uplist and strengthen investor transparency.

POMPANO BEACH, FL, November 13, 2025 – PRISM MediaWire (Press Release Service – Press Release Distribution) – BioStem Technologies, Inc. (OTC: BSEM), a leading MedTech company focused on the development, manufacturing, and commercialization of placental-derived products for advanced wound care, today announced the filing of its restated interim financial statements for the periods from Q1 2024 through Q2 2025 as well as its restated annual financial statements for 2023 and 2024.

“Completing our restated financial statements is a significant milestone for the Company. This restatement was the culmination of a comprehensive review of the applicable US GAAP revenue recognition guidance in consultation with our external technical accounting advisors, and best accounts for our distribution agreement with Venture Medical. With this process behind us, we are ready to move forward with our independent audit and subsequent uplist process.”

Brandon Poe, CFO of BioStem, BioStem Technologies, Inc.

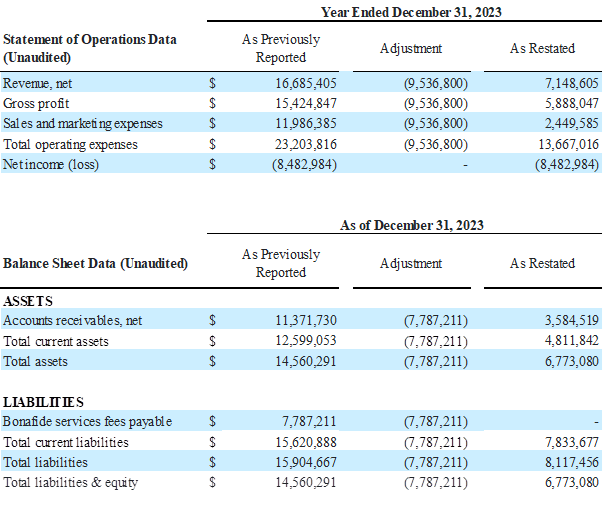

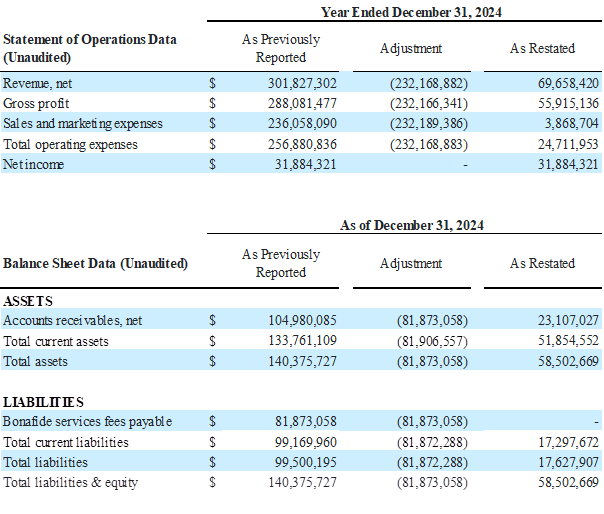

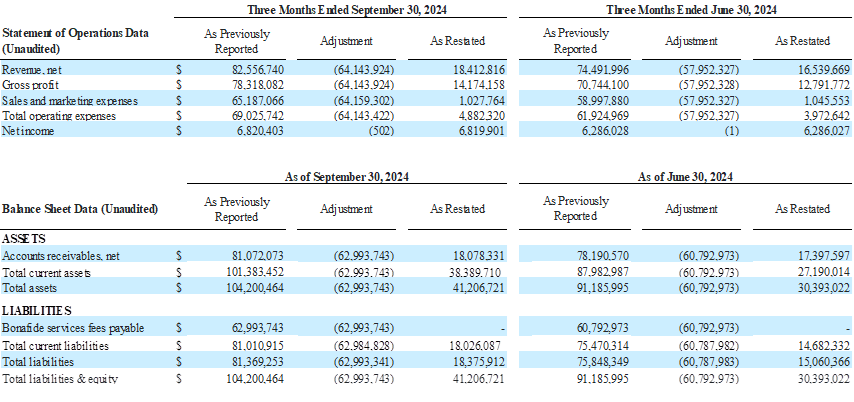

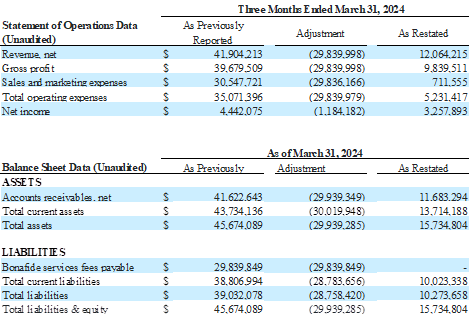

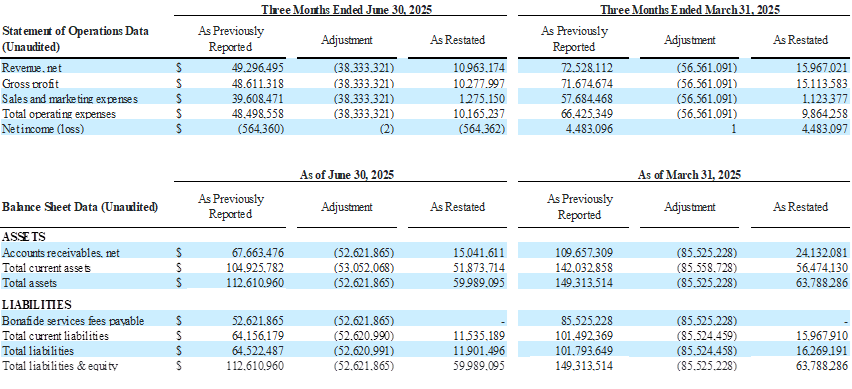

The Company’s restated financial statements adjust how it accounts for and reports the bona fide services fees associated with its distribution agreement with Venture Medical. This change impacts both the income statement and the balance sheet.

Previously, bona fide services fees were recorded as a Sales and Marketing expense on the consolidated statements of operations. In the restated consolidated statements of operations, and going forward beginning in the third quarter of 2025, these fees are now classified as a contra revenue, meaning they are reported as a reduction of gross revenue to arrive at net revenue. This change lowers reported revenue and lowers Sales and Marketing expense by the same amount, but does not impact EBITDA, net income, or cash flow. However, because revenue is now reported net, percentage-based metrics such as gross margin and EBITDA margin will look slightly different.

On the balance sheets, the amounts owed by BioStem to Venture related to Bonafide services fees payable were previously shown as a separate current liability. Now, they are netted against Accounts Receivable due from Venture, effectively offsetting the amounts owed between the two companies.

“The underlying strength of our business is unchanged as we continue to deliver clinically validated wound care products to the market. These updated financials continue to demonstrate the resilience of our business model as our industry leading gross margins and disciplined cost structure enable continued profitability, as well as the ability to generate strong cash flows as we scale the business,” said Jason Matuszewski, CEO and Chairman of the Board of BioStem. “Restating our financial statements advances our progress toward uplisting and we remain extremely excited about the future ahead for BioStem as we continue to strengthen the financial, operational and clinical foundations of the business.”

Jason Matuszewski, CEO and Chairman of the Board of BioStem BioStem Technologies, Inc.

This restatement remains subject to completion of the independent audit to be conducted by the Company’s newly appointed external auditors, KPMG. The Company anticipates that the independent audits for fiscal years 2024 and 2025 will be completed by the end of Q1 2026.

About BioStem Technologies, Inc. (OTC: BSEM): BioStem Technologies is a leading innovator focused on harnessing the natural properties of perinatal tissue in the development, manufacture, and commercialization of allografts for regenerative therapies. The Company is focused on manufacturing products that change lives, leveraging its proprietary BioREtain®processing method. BioREtain®has been developed by applying the latest research in regenerative medicine, focused on maintaining growth factors and preserving tissue structure. BioStem Technologies’ quality management system and standard operating procedures have been reviewed and accredited by the American Association of Tissue Banks (“AATB”). These systems and procedures are established per current Good Tissue Practices (“cGTP”) and current Good Manufacturing Processes (“cGMP”). Our portfolio of quality brands includes AmnioWrap2™, VENDAJE®, VENDAJE AC®, VENDAJE OPTIC®, American Amnion, and American Amnion AC. Each BioStem Technologies placental allograft is processed at the Company’s FDA registered and AATB accredited site in Pompano Beach, Florida. For more information visit biostemtechnologies.com and follow us on Twitter and LinkedIn.

Join BioStem’s Distribution List & Social Media:

To follow the latest developments at BioStem, sign up for the Company’s email distribution list HERE, and follow us on X and LinkedIn.

Forward-Looking Statements:

Forward-looking statements in this release include, among other things, statements regarding: the preliminary financial results for the third quarter 2025; the Company’s expectations regarding clinical trial results, including the anticipated timing of current and planned clinical trials; the timing of enrollment and publication of data from such trials; the expectation that such trials will demonstrate the clinical superiority of the Company’s products; the Company’s expectations regarding completion of its audit and its ability to uplist to Nasdaq; the Company’s strategic initiatives; third quarter and full year 2025 projections; continued financial growth; and the market penetration of the Company’s core products.

Forward-looking statements with respect to the operations of the Company, strategies, prospects and other aspects of the business of the Company are based on current expectations that are subject to known and unknown risks and uncertainties, which could cause actual results or outcomes to differ materially from expectations expressed or implied by such forward-looking statements. These factors include, but are not limited to: the impact of any changes to the reimbursement levels for the Company’s products; significant and continuing competition, which could adversely affect the Company’s business, results of operations and financial condition; rapid technological change, which could cause the Company’s products to become outdated or obsolete, harming the Company’s ability to effectively compete; the Company’s ability to convince physicians that its products are safe and effective alternatives to existing treatments and that its products should be used in their procedures; the risk that the Company may be unable to successfully market its products to the end users of such products; the Company’s ability to obtain coverage of its products when, or if, the future local coverage determinations are implemented; the risk that the Company may be unable to raise capital on the terms acceptable to it, or at all, which could have a material adverse impact on the Company’s business, financial condition, and prospects; the impact of any changes to the accounting treatment of the Company’s revenue and expenses; the Company’s ability to obtain financing to expand its business; the Company has incurred significant losses since inception and may incur losses in the future; changes in applicable laws or regulations; the Company’s ability to maintain production of its products in sufficient quantities to meet demand; the impact of any changes in applicable laws or regulations; and the possibility that the Company may be adversely affected by other general economic, business, and/or competitive factors. There may be additional risks about which the Company is presently unaware of or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company undertakes no duty to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contact BioStem Technologies, Inc.:

Website: www.biostemtechnologies.com

E-Mail: info@biostemtech.com

X: @BSEM_Tech

Facebook: BioStemTechnologies

Phone: 954-380-8342

Investor Relations:

Philip Trip Taylor, Gilmartin Group

E-Mail: ir@biostemtech.com

Impact of the Restatement as of and for the Year Ended December 31, 2023

Impact of the Restatement as of and for the Year Ended December 31, 2024

Impact of the Restatement as of and for the Quarters ended September 30, 2024, June 30, 2024, and March 31, 2024

Impact of the Restatement as of and for the Quarters ended September 30, 2024, June 30, 2024, and March 31, 2024 (continued)

Impact of the Restatement as of and for the Quarters ended June 30, 2025, and March 31, 2025

Source: BioStem Technologies, Inc.