Third-Quarter Net Revenue of $4.8 million; Robust Growth Drives 35% Increase in Net Revenue and Fourth Consecutive Quarter of Profitability

SOUTH ORANGE, NJ, November 6, 2025 – PRISM MediaWire (Press Release Service – Press Release Distribution) – Nephros, Inc. (Nasdaq: NEPH), a leading water technology company providing filtration solutions to the medical and commercial markets, today announced financial results for the third quarter ended September 30, 2025.

Financial Highlights

Net revenue increased 35% to $4.8 million compared to $3.5 million in the third quarter of 2024

Net income increased 84% to $337,000, compared to $183,000 in the third quarter of 2024

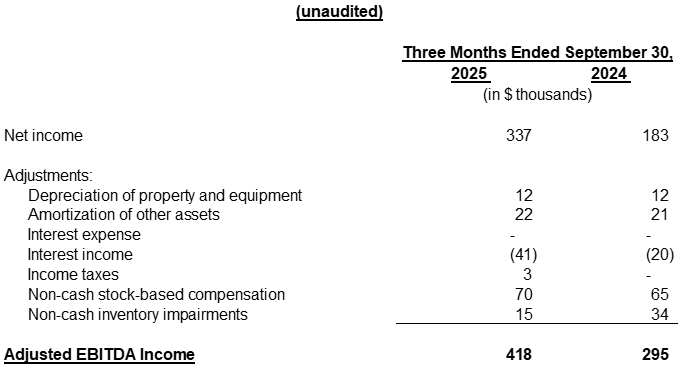

Adjusted EBITDA increased 42% to $418,000, compared to $295,000 in the third quarter of 2024

For the nine months ended September 30, 2025:

Net revenue increased 37% to $14.1 million, compared to $10.3 million in the same period of 2024

Net income was $1.1 million, compared to a net loss of ($275,000) in the same period of 2024

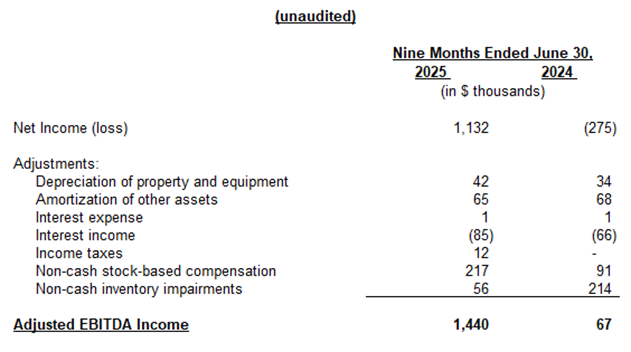

Adjusted EBITDA was $1.4 million, compared to $67,000 in the same period of 2024

“Q3 2025 marks another powerful milestone—delivering not only continued profitability but achieving the highest level of programmatic sales in company history,” said Robert Banks, President and Chief Executive Officer of Nephros. “This performance is a direct result of our strategic focus on the execution of customer-centered initiatives. By expanding our series of educational webinars, on-site training, and field installation and replacement capabilities, we helped facilities achieve stronger results from their water treatment programs. Collectively, these efforts created sustainable value for both our customers and company.”

“It’s an energizing time at Nephros as we are also seeing the impact of our recent investments in innovation,” Banks continued. “In the third quarter, we finalized development and market preparation for our new PFAS filtration solution, which officially launched in early October. This latest release positions Nephros to expand into new markets where water quality is critical and regulatory standards drive action. In parallel, the same customer-centered initiatives that strengthened our programmatic business also supported expansion in the number of active sites across all key segments—infection control, dialysis, and commercial. These results provide further evidence that our approach resonates with customers seeking reliable support, who value both product quality and consistent high performance.”

Mr. Banks concluded, “With strong cash reserves, zero debt, and a robust innovation pipeline, we remain confident that Nephros is well-positioned to sustain growth, broaden our market reach, and deliver durable value in the quarters ahead.”

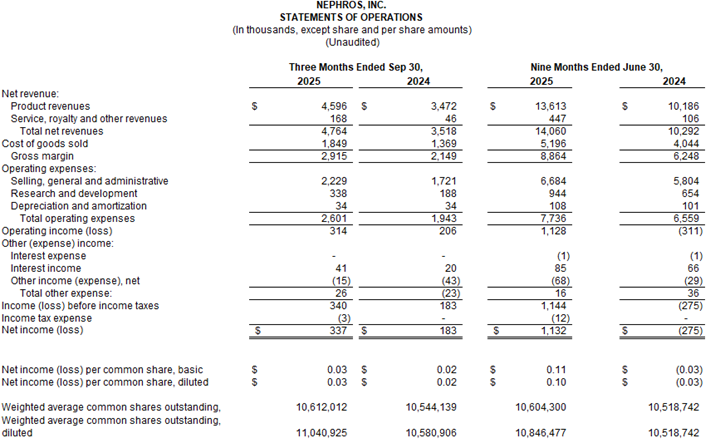

Financial Performance for the Quarter Ended September 30, 2025

Net revenue for the three months ended September 30, 2025, and 2024 was $4.8 million and $3.5 million, respectively, an increase of 35%. Our core programmatic revenue grew by 51% over the same period in 2024. The increase in programmatic sales reflects strong reorders, a number of new active sites and significant growth in our service revenue.

Cost of goods sold for the third quarter of 2025 was $1.9 million, compared with $1.4 million in the third quarter of 2024, an increase of 35%. Gross margin for the third quarter of 2025 was 61%, consistent with 61% in the third quarter of 2024.

Selling, general and administrative expenses for the third quarter of 2025 were approximately $2.2 million, compared with $1.7 million in 2024, an increase of 30% due to higher sales commissions resulting from increased revenue, and higher accrual for employee bonuses.

Research and development expenses were approximately $0.3 million for the third quarter of 2025, compared with $0.2 million reported in the third quarter of 2024, an increase of 80% due to higher accrual for employee bonuses and higher salary expense.

Depreciation and amortization expenses were approximately $34,000 for the third quarter of 2025, consistent with approximately $34,000 in the third quarter of 2024.

As a result of the improved sales, net income for the third quarter of 2025 was $0.3 million, compared with $0.2 million during the same period in 2024, marking four consecutive quarters of net income in the Company’s history.

Adjusted EBITDA for the third quarter 2025 was approximately $0.4 million, compared with approximately $0.3 million in the third quarter of 2024.

Financial Performance for the Nine Months Ended September 30, 2025

Net revenue for the nine months ended September 30, 2025, and 2024 was $14.1 million, and $10.3 million respectively, an increase of 37%. This increase was primarily driven by increased revenue in both programmatic and emergency response. Our core programmatic revenue grew by 35% over the same period in 2024. The increase in programmatic sales reflects strong reorders, and a number of new active sites. We also saw significant growth in our service revenue.

Cost of goods sold for the nine months ending September 30, 2025, and 2024 was $5.2 million and $4 million, respectively, an increase of 28%. Gross margin for the nine months ended September 30, 2025, was 63%, compared with 61% during the same period in 2024. The increase in gross margin was primarily driven by lower product costs resulting from a more favorable product mix and a reduction in inventory reserve adjustments.

Selling, general and administrative expenses for the nine months ended September 30, 2025, and 2024 were approximately $6.7 million and $5.8 million, respectively, an increase of 15% primarily driven by higher sales commission expense, increased employee bonus accruals, and higher stock-based compensation expense.

Research and development expenses for the nine months ending September 30, 2025, and 2024 were $0.9 million and $0.7 million, respectively, an increase of 44% primarily due to higher accrual for employee bonuses and higher salary expense.

Depreciation and amortization expenses for the nine months ending September 30, 2025, and 2024 were approximately $108,000, and $101,000 respectively.

As a result of the improved sales and gross margins, net income for the nine months ending September 30, 2025, was $1.1 million compared to a net loss of ($0.3 million) during the same period in 2024.

Adjusted EBITDA for the nine months ending September 30, 2025, was approximately $1.4 million, compared with approximately $0.1 million in the same period of 2024.

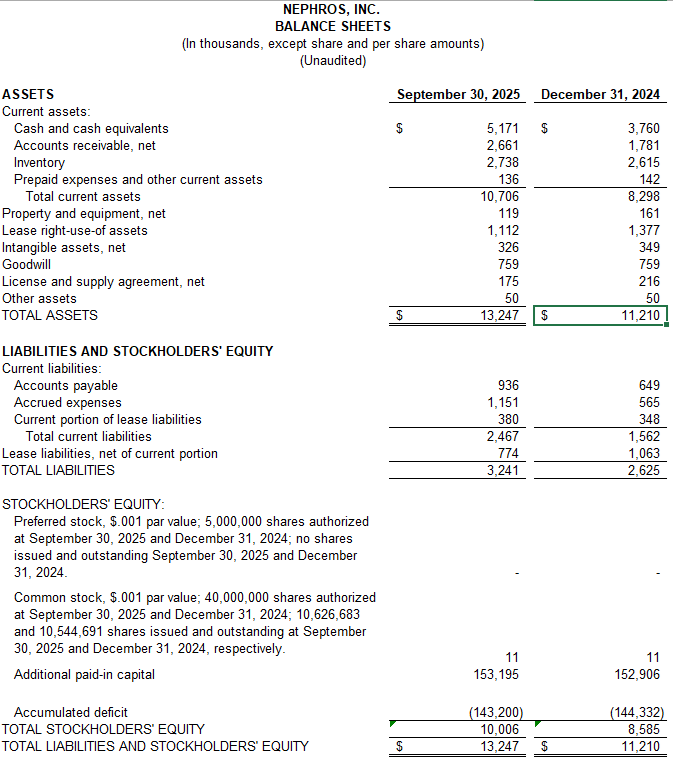

As of September 30, 2025, Nephros had cash and cash equivalents of approximately $5.2 million, compared to $3.8 million as of December 31, 2024, and remains debt free.

Adjusted EBITDA Definition and Reconciliation to GAAP Financial Measures

Adjusted EBITDA is calculated by taking net income (loss) calculated in accordance with generally accepted accounting principles (“GAAP”) and excluding all interest-related expenses and income, tax-related expenses and income, non-recurring expenses and income, and non-cash items, including depreciation, amortization, non-cash inventory write-offs, and non-cash compensation. The following tables present a reconciliation of Adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure, for the third quarter and year-to-date period of the 2025 fiscal year:

Adjusted EBITDA Income (loss)

Nephros believes that Adjusted EBITDA provides useful information to management and investors regarding certain financial and business trends relating to Nephros’ financial condition and results of operations. Management does not consider Adjusted EBITDA in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of Adjusted EBITDA is that it excludes significant expenses and income that are required by GAAP to be recognized in Nephros’ financial statements. In addition, Adjusted EBITDA is subject to inherent limitations as it reflects the exercise of judgments by management about which expenses and income are excluded or included in determining Adjusted EBITDA. To compensate for these limitations, management presents Adjusted EBITDA in connection with net income (loss), the most directly comparable GAAP financial measure. Nephros urges investors to review the reconciliation of Adjusted EBITDA to net income (loss) and not to rely on any single financial measure to evaluate the business.

About Nephros

Nephros is committed to improving the human relationship with water through leading, accessible technology. We provide innovative water filtration products and services, along with water-quality education, as part of an integrated approach to water safety. Nephros goods serve the needs of customers within healthcare and commercial markets, offering both proactive and emergency solutions for water management.

For more information about Nephros, please visit nephros.com.

Forward-Looking Statements

This release contains forward-looking statements that are subject to various risks and uncertainties. Such statements include statements regarding Nephros’ expected future revenue growth and the timing of such growth, the extent to which Nephros’ customer installation and replacement programs will lead to increased product reorders and revenue, the extent to which Nephros’ operational activities and product innovations will lead to revenue growth, Nephros’ ability to continue realizing net income from its operations, the effect of new regulations on future revenue growth, the expected competitive advantages and anticipated impact of new product offerings, and other statements that are not historical facts, including statements that may be accompanied by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including Nephros’ ability to further develop its sales organization and realize increased revenues, the extent to which financial results based on emergency response sales can be outside Nephros’ control, the extent to which U.S. tariffs may increase our expenses, inflationary factors and other economic and competitive conditions, the availability of capital when needed, dependence on third-party manufacturers and researchers, and regulatory reforms. These and other risks and uncertainties are detailed in Nephros’ reports filed with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2024, which it may update in Part II, Item 1A – Risk Factors in its Quarterly Reports on Form 10-Q that it has filed or will file hereafter. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of this release, and Nephros does not undertake any responsibility to update any forward-looking statements that it makes, except as may be required by law.

Investor Relations Contacts:

Kirin Smith, President

PCG Advisory, Inc.

(646) 823-8656

ksmith@pcgadvisory.com

Robert Banks, CEO

Nephros, Inc.

(201) 343-5202 x110

robert.banks@nephros.com

Source: Nephros, Inc.